Washington State Employee Compensation Timeline

Navigating the landscape of public sector employment often involves understanding compensation structures. For those interested in or currently working for Washington State, the WA state employee pay schedule is a crucial aspect of employment. This article provides a comprehensive guide to understanding the compensation system for Washington State employees.

Washington State employs a diverse workforce, from educators and healthcare professionals to those involved in infrastructure and public safety. Each position comes with specific compensation guidelines outlined in the Washington state employee salary schedule. Understanding these schedules is vital for managing personal finances and career planning.

The Washington state government pay schedule outlines the salary ranges for different job classifications. These classifications consider factors like education, experience, and the complexity of the role. The schedule is designed to ensure fair and equitable compensation across various state agencies.

Understanding the nuances of the WA state employee pay schedule goes beyond just knowing your salary. It includes understanding benefits, deductions, and the timing of payments. This knowledge empowers employees to make informed financial decisions.

This comprehensive guide aims to demystify the WA state employee payroll schedule. We will delve into the various facets of the compensation system, covering topics such as pay periods, deductions, benefits, and how to access your pay information online. Whether you are a prospective employee or a seasoned veteran, this resource will equip you with valuable insights.

The history of the WA state employee pay schedule has evolved over time, reflecting changes in economic conditions, legislation, and collective bargaining agreements. Initially, pay schedules were likely simpler, but as the state government grew and diversified, the need for a more structured and transparent system arose.

The WA state employee compensation schedule plays a crucial role in attracting and retaining qualified individuals to public service. Competitive compensation helps ensure that the state can recruit the best talent to serve its citizens.

One of the main issues surrounding the WA state employee pay schedule is ensuring that it remains competitive with the private sector. The state government regularly reviews and adjusts the schedule to reflect market conditions and cost-of-living adjustments. This continuous review aims to balance fiscal responsibility with fair compensation.

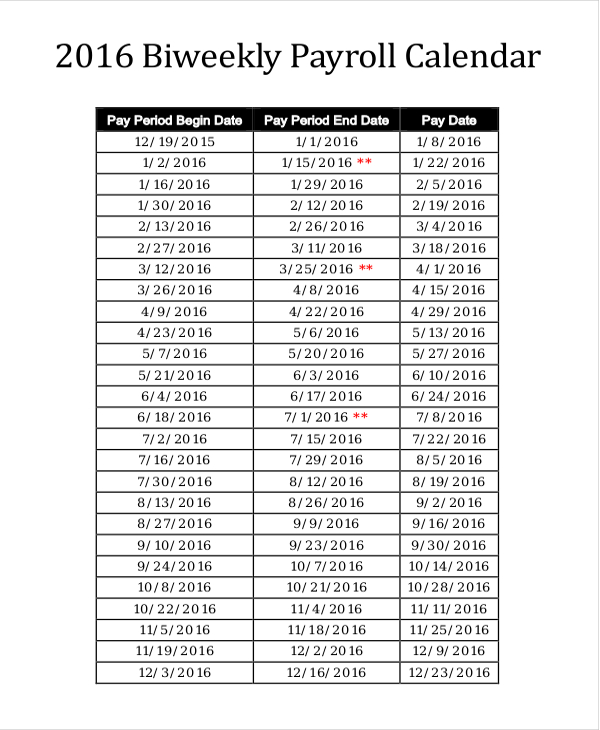

The WA state employee payment schedule generally follows a bi-weekly or semi-monthly pay cycle. Employees can access their pay stubs and other compensation information through the state's online portal. This online access provides convenience and transparency in managing payroll information.

Benefits of the WA state employee pay schedule include competitive salaries, comprehensive health benefits, and retirement plans. These benefits contribute to overall financial security and well-being.

Tips for managing your WA state employee pay include budgeting effectively, understanding tax withholdings, and taking advantage of available retirement savings plans. These practices contribute to long-term financial health.

Advantages and Disadvantages of a Structured Pay Schedule

| Advantages | Disadvantages |

|---|---|

| Transparency and Predictability | Limited Flexibility |

| Fairness and Equity | Potential Salary Compression |

| Simplified Budgeting | Difficulty Addressing Unique Circumstances |

Frequently Asked Questions about WA State Employee Pay Schedule:

1. How often are employees paid? Generally, bi-weekly or semi-monthly.

2. How can I access my pay stubs? Through the state's online employee portal.

3. What deductions are taken from my paycheck? Taxes, retirement contributions, health insurance premiums, etc.

4. How are overtime hours calculated? According to state regulations and collective bargaining agreements.

5. How can I update my direct deposit information? Through the state's online employee portal.

6. Who can I contact with questions about my pay? Your agency's human resources department.

7. How are salary increases determined? Based on performance evaluations, cost-of-living adjustments, and collective bargaining agreements.

8. Where can I find the current WA state employee pay schedule? On the Washington State Office of Financial Management website.

In conclusion, the WA state employee pay schedule is a complex yet essential component of public sector employment in Washington. Understanding its intricacies, from pay periods and deductions to benefits and online resources, empowers employees to manage their finances effectively. The system aims to provide fair and competitive compensation while ensuring fiscal responsibility. By staying informed and utilizing available resources, WA state employees can navigate the compensation system with confidence and plan for their financial future. For further details and the most up-to-date information, consult the Washington State Office of Financial Management website.

Unlocking the secrets of the millstone public house food offerings

Decoding virginias state holidays

Starbucks cake pops recipe craze decoded