Navigating Wells Fargo Bank Wire Transfers

Imagine money as a flock of birds. You want to send these birds across the country, quickly and efficiently. You wouldn't just open a window and hope they all fly in the right direction. You’d need a reliable system, a flight plan. For your money, a wire transfer is that flight plan, and knowing how to initiate one with Wells Fargo is key.

A Wells Fargo bank wire transfer is an electronic method of moving funds from one bank account to another, either domestically or internationally. It's like a high-speed train for your money, significantly faster than traditional methods like checks. This service allows for near real-time transfer of funds, which is crucial for time-sensitive transactions. But before you send those funds soaring, understanding the nuances of the process is vital.

Thinking about getting a Wells Fargo wire transfer contact number? It's understandable to want a direct line to navigate the process. While finding a specific "Wells Fargo bank wire transfer phone number" might seem like the holy grail, directly contacting your local branch or utilizing the general customer service number is often the most effective approach. These channels can connect you with the right experts who can guide you through the specific steps required for your wire transfer.

Why is understanding the process of a Wells Fargo bank wire transfer so important? In today's fast-paced world, quickly moving money is often critical. Whether it's a down payment on a house, a crucial business transaction, or sending funds to family overseas, wire transfers provide the speed and security you need. However, unlike sending a casual email, wire transfers involve specific protocols and information that must be accurate to ensure the funds reach their intended destination.

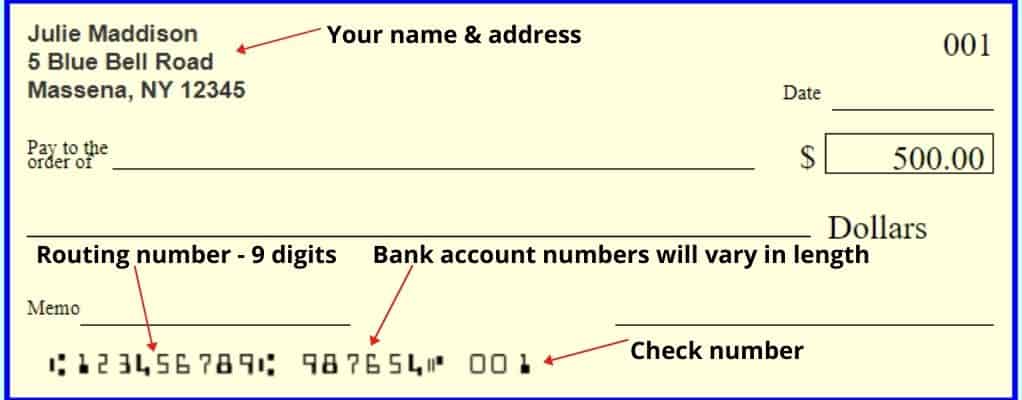

Before initiating a Wells Fargo wire transfer, gathering all the necessary information is crucial. Think of it like packing for a long journey – you wouldn’t want to leave without your passport or ticket. Similarly, for a wire transfer, you’ll need the recipient's bank name and address, their account number, the SWIFT code for international transfers, and the exact amount you wish to transfer. Having these details readily available will streamline the process and prevent delays.

Historically, wire transfers have evolved from telegraphic transfers, originating in the late 19th century. Today, they are predominantly electronic and rely on secure networks for transmitting information. The Wells Fargo wire transfer process leverages this technology to facilitate fast and secure movement of funds for its customers. Key issues relating to wire transfers include security concerns, potential fees, and the importance of accurate information to avoid delays or misdirection of funds.

One of the benefits of using a wire transfer is speed. Funds can often be available within the same business day, especially for domestic transfers. Another advantage is the security offered by the electronic system. Lastly, wire transfers offer a certain level of finality. Once the transfer is complete, it is generally irreversible, providing assurance to both the sender and the recipient.

Advantages and Disadvantages of Wells Fargo Bank Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversibility |

| Global Reach | Potential for Fraud (if precautions aren't taken) |

Frequently Asked Questions about Wells Fargo Wire Transfers:

1. What information do I need to send a wire transfer? (Answer: Recipient's bank name, address, account number, SWIFT code (international), and the transfer amount)

2. How long does a wire transfer take? (Answer: Typically within the same business day for domestic transfers, but international transfers may take longer.)

3. What are the fees associated with a wire transfer? (Answer: Fees vary depending on whether the transfer is domestic or international and can be confirmed with Wells Fargo directly.)

4. How do I track my wire transfer? (Answer: You can usually track your transfer through your Wells Fargo online banking platform or by contacting customer service.)

5. Can I cancel a wire transfer? (Answer: It's difficult to cancel a wire transfer once it's been initiated, so accuracy of information is paramount.)

6. What security measures are in place to protect my wire transfer? (Answer: Wells Fargo utilizes various security measures, including encryption and fraud monitoring, to protect your transactions.)

7. Is there a limit on the amount I can transfer? (Answer: Limits may apply and can be confirmed with Wells Fargo.)

8. What should I do if my wire transfer doesn't arrive? (Answer: Contact Wells Fargo customer service immediately.)

Tips for a smooth wire transfer: Double-check all recipient details, initiate the transfer during business hours for faster processing, and keep your confirmation number for tracking purposes.

In conclusion, navigating the world of Wells Fargo bank wire transfers requires understanding the process, gathering the correct information, and being aware of the potential fees and security considerations. While searching for a specific "Wells Fargo bank wire transfer phone number" might seem like a shortcut, utilizing the readily available resources like your local branch or general customer service will likely provide the most efficient and accurate guidance. By understanding the benefits and potential challenges of wire transfers, and by following the recommended best practices, you can ensure your funds reach their destination quickly and securely. Remember, much like that flock of birds, your money deserves a safe and reliable flight plan. Take the time to plan your transfer carefully, and you can send your funds soaring with confidence.

Transform your space with benjamin moore bavarian cream

Unlocking your boats secrets finding the hull identification number hin

Tri cities youth basketball a slam dunk for young athletes