Decoding the Nuances of Western Union Money Transfer Expenses

In the interconnected world we inhabit, the need to move money across borders has become commonplace. Whether supporting family abroad, settling international transactions, or managing finances across continents, the flow of funds is a vital artery in the global economy. This necessitates a deep understanding of the mechanisms and, crucially, the costs associated with international money transfers. This exploration delves into the intricacies of Western Union's money transfer pricing, providing a nuanced perspective on its fees, exchange rates, and potential cost-saving strategies.

For generations, Western Union has been a prominent figure in the remittance landscape, facilitating the transfer of funds between individuals and businesses worldwide. Their extensive network and established presence make them a readily accessible option for many. However, navigating the financial implications of using their services requires careful consideration of the various factors that influence the overall expense.

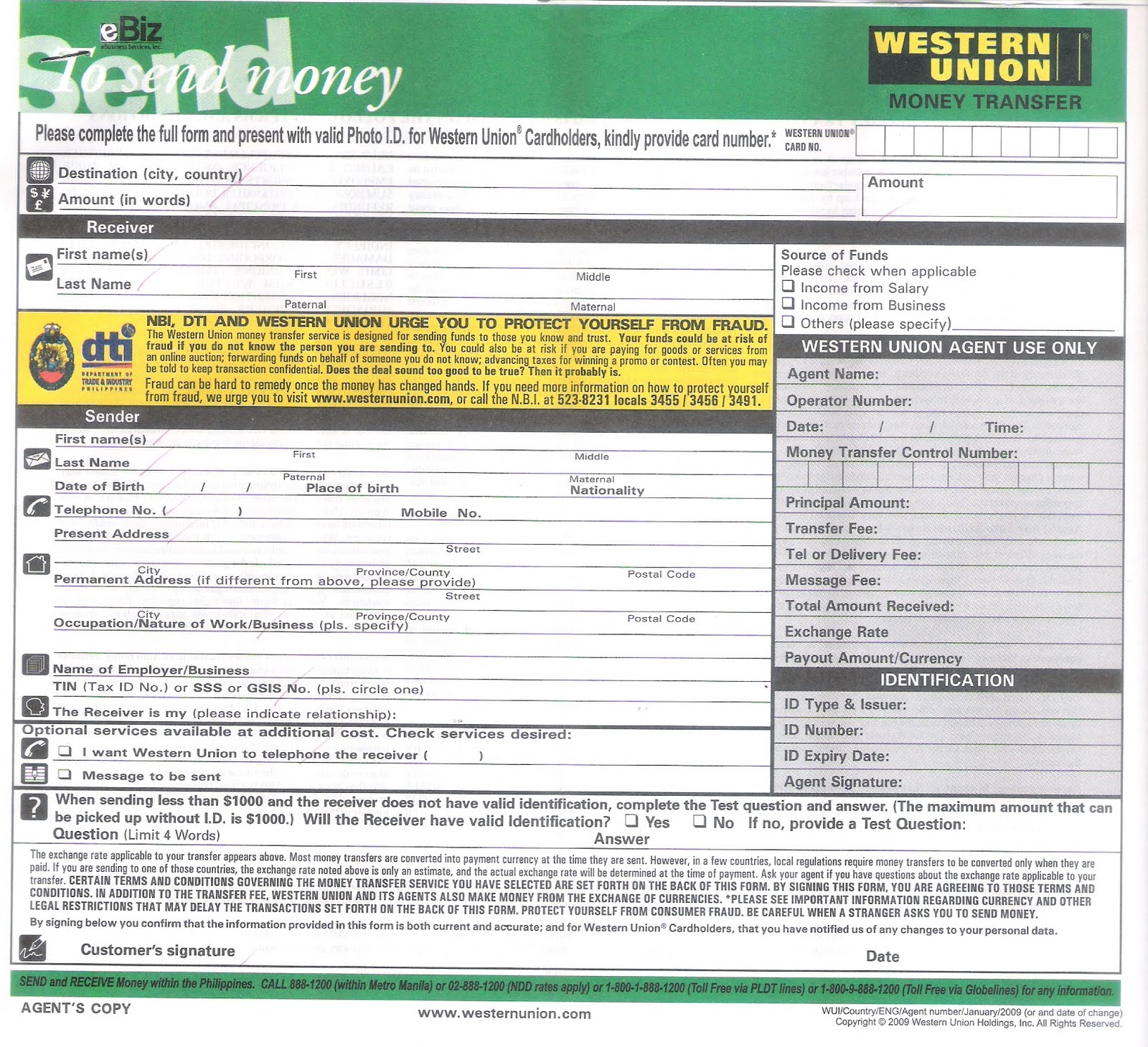

The price of sending money via Western Union isn't a static figure. It's a dynamic calculation influenced by a confluence of elements. The amount being sent, the destination country, the chosen payment and delivery method—these all play a role in determining the ultimate cost. Understanding these variables is key to making informed decisions and optimizing your transfers for cost-effectiveness.

Historically, Western Union began as a telegraph company in the mid-19th century, eventually evolving into a leading money transfer service. Its global reach has made it an integral part of many communities, particularly for migrant workers sending remittances home. This historical context highlights the importance of understanding the service's pricing structure, particularly for those who rely on it for essential financial support.

A crucial aspect of Western Union's pricing is the exchange rate applied to your transaction. This rate often differs from the mid-market rate (the midpoint between the buy and sell rates for a given currency pair) and typically includes a markup. This markup represents a portion of Western Union's revenue and is a significant factor affecting the overall cost. Comparing the exchange rate offered by Western Union with the prevailing mid-market rate can provide valuable insights into the true cost of your transfer.

One way to potentially reduce the expense of Western Union transfers is to explore different payment methods. Paying with a bank transfer or debit card might incur lower fees compared to using a credit card. Similarly, opting for a bank account deposit at the receiving end might be more economical than a cash pickup.

Another strategy involves comparing Western Union's prices with those of other money transfer providers. This comparative analysis can reveal more competitive options and help you secure the most favorable exchange rates and fees. It also empowers you to make informed decisions based on your specific needs and financial circumstances.

Planning your transfers strategically can also contribute to cost savings. Sending larger amounts less frequently, instead of multiple smaller transfers, can minimize the cumulative impact of fees. This proactive approach can make a noticeable difference over time.

Advantages and Disadvantages of Using Western Union

| Advantages | Disadvantages |

|---|---|

| Widely accessible global network | Potentially higher fees compared to other services |

| Various payment and delivery options | Exchange rate markups can affect the overall cost |

| Fast transfer speeds | Limited customer support in some regions |

Frequently Asked Questions:

1. How can I find the Western Union transfer fees? You can use their online cost estimator or contact customer service.

2. What influences the exchange rate applied by Western Union? Market conditions and Western Union's own markup.

3. Can I track my Western Union transfer? Yes, using the tracking number provided.

4. What are the payment options for sending money with Western Union? Bank transfer, debit card, credit card, and cash at agent locations.

5. How long does a Western Union transfer take? It can range from minutes to several days depending on the chosen method.

6. What are the receiving options for Western Union transfers? Bank account deposit, cash pickup, and mobile wallet.

7. How can I find a Western Union agent location? Use the online agent locator.

8. What should I do if I encounter issues with my Western Union transfer? Contact their customer support.

In conclusion, navigating the intricacies of Western Union money transfer expenses requires a nuanced understanding of the various factors influencing the final cost. From the exchange rate and transfer fees to payment and delivery methods, each element contributes to the overall expense. By carefully considering these factors, comparing options, and planning strategically, you can make informed decisions that optimize your transfers for cost-effectiveness. Remember that staying informed about the latest updates to Western Union's pricing structure is crucial for ensuring efficient and economical money transfers. The global flow of funds is a vital part of our interconnected world, and understanding the associated costs empowers us to manage our finances effectively across borders. Take the time to research, compare, and choose wisely to ensure your money reaches its destination in the most efficient and cost-effective manner possible.

Unlocking the best deal on a new bmw x5 near you

Navigating the ache when you miss your best friend

Unlocking starbucks on doordash a guide to gift card redemption