Decoding Federal Special Pay Rates

Navigating the complexities of federal compensation can be daunting. One crucial aspect is understanding how special pay rates factor into the overall picture. This comprehensive guide aims to demystify federal government special pay rate tables, providing insights into their purpose, application, and implications for federal employees.

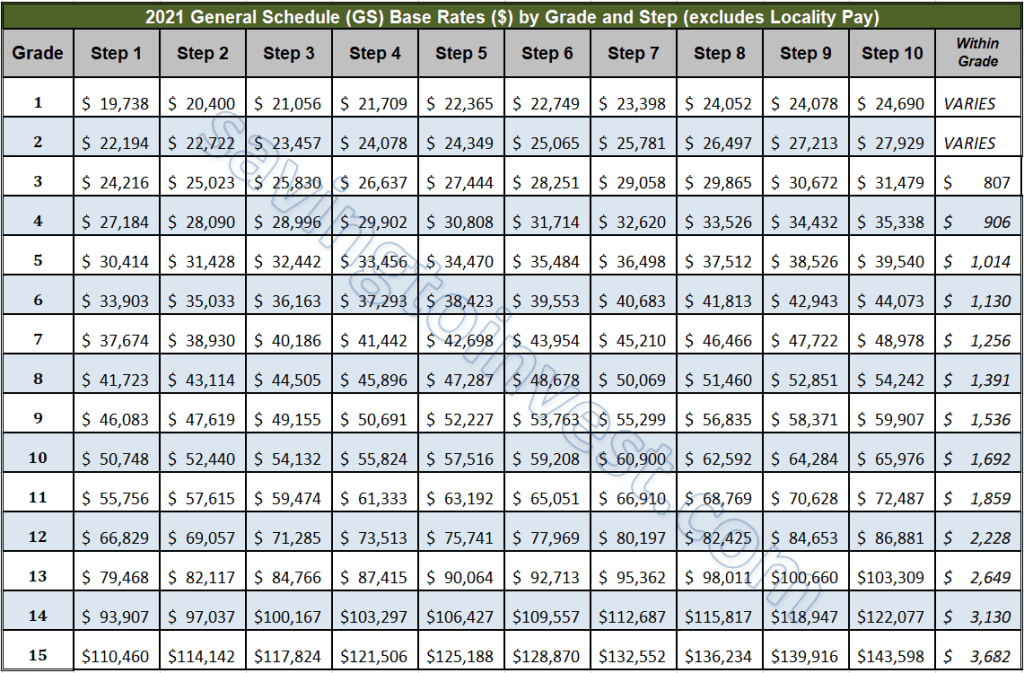

Federal government special pay rate tables are specialized compensation schedules designed to address unique employment circumstances within the federal workforce. They deviate from the standard General Schedule (GS) pay scale to account for factors such as hazardous duty, locality adjustments, and specific skill sets in high-demand fields. These adjustments ensure fair and competitive compensation for employees in roles requiring specialized knowledge, skills, or working conditions.

The origins of special pay rates can be traced back to the need to attract and retain qualified individuals in critical government positions. Over time, these provisions have evolved to encompass a wide range of occupations and circumstances, reflecting the changing needs of the federal government. The importance of these specialized pay tables lies in their ability to incentivize employees to take on challenging or demanding roles, ultimately contributing to the effective functioning of government agencies.

One key issue surrounding federal special pay rate schedules revolves around maintaining equity and transparency. Ensuring that these specialized pay provisions are applied consistently and fairly across different agencies and positions is crucial for preventing discrepancies and maintaining employee morale. Understanding the rationale behind specific special pay rates and how they are calculated is essential for both employees and managers.

Several categories of special pay exist within the federal government. Examples include hazard pay for employees working in dangerous environments, locality pay adjustments to reflect cost-of-living differences, and special rate supplements for occupations experiencing critical staffing shortages. Each category has its own set of eligibility criteria and calculation methods, resulting in a complex web of pay regulations.

One benefit of federal special pay rates is the enhanced recruitment and retention of qualified personnel for critical positions. By offering higher compensation for challenging or hazardous roles, the government can attract and keep skilled individuals who might otherwise seek employment in the private sector. For example, special pay rates for law enforcement officers can incentivize experienced professionals to join federal agencies.

Another advantage is the recognition of specialized skills and expertise. Special rate tables for occupations like engineers or scientists acknowledge the value of these specialized skill sets and compensate individuals accordingly. This can boost employee morale and encourage professional development within these fields.

Furthermore, special pay rates contribute to maintaining a competitive edge in the labor market. By offering competitive salaries for in-demand occupations, the federal government can attract top talent and ensure it has the workforce necessary to fulfill its mission.

Best practices for implementing federal government special pay rate tables include clear communication of eligibility criteria, consistent application of pay regulations, and regular review of special pay provisions to ensure they remain relevant and effective.

Real-world examples of special pay rates include those for firefighters, air traffic controllers, and medical professionals within federal agencies. These examples highlight the diverse range of occupations where special pay provisions apply.

Advantages and Disadvantages of Federal Special Pay Rates

| Advantages | Disadvantages |

|---|---|

| Attracts and retains qualified employees | Can create pay disparities within agencies |

| Recognizes specialized skills | Complex regulations can be difficult to navigate |

| Maintains competitiveness in the labor market | Subject to budgetary constraints |

Frequently Asked Questions about Federal Special Pay Rate Tables:

1. Q: Where can I find the current special pay rate tables? A: The Office of Personnel Management (OPM) website provides access to current pay tables.

2. Q: How are locality pay adjustments calculated? A: Locality pay is based on geographic location and cost-of-living data.

3. Q: Am I eligible for special pay? A: Eligibility criteria vary depending on the specific special pay category.

4. Q: How do I apply for special pay? A: Contact your agency's human resources department for information on applying for special pay.

5. Q: What is hazard pay? A: Hazard pay compensates employees for working in dangerous or unhealthy conditions.

6. Q: How often are special pay rates updated? A: Special pay rates are typically reviewed and updated annually.

7. Q: Can special pay rates be combined with other pay adjustments? A: In some cases, yes, but specific regulations apply.

8. Q: Where can I find more information on special pay regulations? A: The OPM website and your agency's human resources department are valuable resources.

In conclusion, federal government special pay rate tables play a crucial role in compensating federal employees fairly and competitively. Understanding these specialized pay schedules is vital for both employees and managers. While these tables address critical needs within the federal workforce, navigating their complexities can be challenging. By staying informed about the various categories of special pay, eligibility criteria, and relevant regulations, federal employees can ensure they receive the appropriate compensation for their unique contributions. Further exploration of resources like the OPM website can provide valuable insights into the intricacies of federal special pay rates, empowering employees to make informed decisions about their careers and compensation. Take the time to thoroughly research and understand these tables, as they can significantly impact your overall earnings and career progression within the federal government.

Farrow and ball denver elevated interior design

Decoding the orange county florida deed office

Rob zombie and sheri moon zombie a visual journey